Money creation in the fiat system — a balance sheet analysis of central banks and banks

Money is the engine of the economy. It is the facilitator of trade and specialization. However, few people ask themselves: where does our money come from? This article discusses the process of money creation at banks and central banks. The analysis is based on the respective balance sheet.

Link to the video covering this article

How the Federal Reserve creates money out of thin air — a balance sheet analysis

This section shows how money is created at the Federal Reserve (Fed), the central bank of the United States. The Fed acts as the bank for the government and as bank for other commercial banks. The Federal Reserve is known to be the “lender of last resort” with the ability to bail out commercial banks. The following analysis is based on the balance sheet of all Federal Reserve Banks combined as published in the annual report 2019 by the Federal Reserve.

The balance sheet of the Fed consists of assets on the one side and liabilities on the other side — just as any company’s balance sheet. The sum of all assets must always be equal to the sum of all liabilities. This is based on the concept of double entry bookkeeping which requires two entries in the balance sheet for every transaction. Assume you are keeping a balance sheet for your personal finances. When you go shopping and pay with cash for food, then there are two entries: a reduction in cash and an increase in food. This fact of every transaction requiring two entries will be important in the further analysis.

Treasury securities and the general account of the treasury

First, we discuss the entries of the Fed’s balance sheet relating to treasury. On the asset side there are „Treasury securities“. On the liability side there is the entry „Treasury, general account“. Treasury securities are bonds issued by the government with varying length and interest rate. The Federal Reserve Bank bought more and more of these government bonds over time thereby providing funding to the government. In 2019, the Fed has claims on the government of more than USD 2.4 trillion. The government is expected to pay this sum with future tax payments by the people since this is the major revenue stream of governments.

These treasuries are considered as zero risk by agreement with the argument that they are backed by the government. This is why government bonds are charged with the lowest interest rates available. Interest rates were artificially reduced by central banks in so far that the phenomenon of negative interest rates emerged which contradicts logic. The yields of one and three month U.S. treasuries turned negative at the end of March 2020. This means that the government is paid for taking on debts which amplifies the incentive of taking on debt.

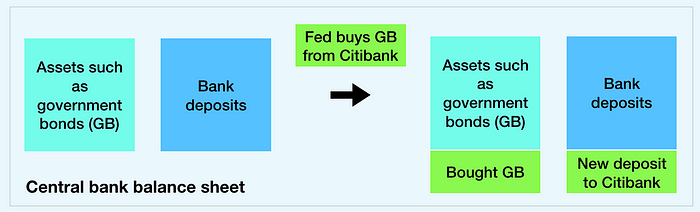

But how did the Federal Reserve fund the money for buying government bonds? By creating it out of thin air. Here comes the double entry bookkeeping into play. On the liabilities side, we find the operational account of the treasury which sums up to USD 403 billion. We see that the Fed can easily create new money by expanding the credit sheet. The book value of the government bonds is placed under „treasury securities“ as assets . This process involves an intermediary bank that buys the government bond from the government which is then sold to the Federal Reserve. Thus, the process is in fact even more complex. An illustration of the process can be found in the end of the article.

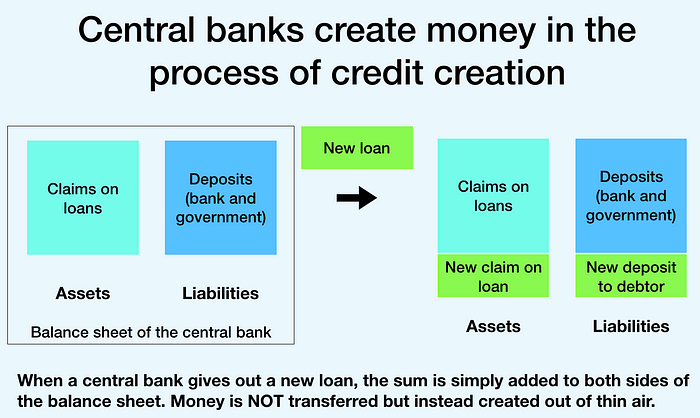

The central bank also creates money by issuing a credit to banks. The value of the loan is noted on the asset side of the central bank and the money loaned is added to the deposit account of the bank on the liabilities side.The process is explained in the figure below.

The government may issue unlimited amounts of government debt and thereby finance its activities. The Fed may infinitely buy government bonds thereby closely collaborating with the government. The annual report states that any surplus of the Fed’s income is transferred to the Treasury which clearly lines out that the Fed works for the government (see screenshot below). In contrast, any company who takes on more and more debt would face higher interest rates due to increased risk. At a certain stage, the company would not be able to take on more debt. On the other side, the government can loan money infinitely through collusion with the Fed who buys treasury securities to the lowest interest rate.

Federal Reserve Notes

Printing new money can be either exercised through book money or by literally printing new money, i.e. Federal Reserve notes. The annual report of the Fed says that “Federal Reserve notes are obligations of the United States government“ which means that by holding a Federal Reserve note one owns a claim on future tax payments — this concept lies at the heart of government backed money. Essentially, the taxpayer is the collateral for Federal Reserve notes. In 2019, the Federal Reserve notes outstanding accumulate to more than USD 1.7 trillion.

The paradox of this system is illustrated in the screenshot below which is taken from the statement named „The Federal Reserve system after 50 years” by the Committee on Banking and Currency which was presented to the Congress in 1964.

Mortgage-backed securities in the Federal Reserve balance sheet

We have discussed the most important entry on the balance sheet of the Federal Reserve which is the claim on the government bonds on the asset side and the general account of the treasury on the liability side. The Federal Reserve, however, does not only hold government bonds as collateral for the Federal Reserve notes. The second largest entry on the assets side of the Fed’s balance sheet are mortgage-backed securities. The entry „Federal Agency and Government-Sponsored Enterprise Mortgage-Backed Securities“ comprises purchases of mortgage-backed securities from “government-sponsored enterprises” such as the Federal National Mortgage Association (Fannie Mae) & Federal Home Loan Mortgage Corporation (Freddie Mac). This means that the Fed owns the claims on house owners’ debt obligations. In general, the buyer of a mortgage-backed security (MBS) has a claim on the real estate in case of credit default. So in case of defaulting MBS, the ownership of the real estate is transferred to the Federal Reserve Bank.

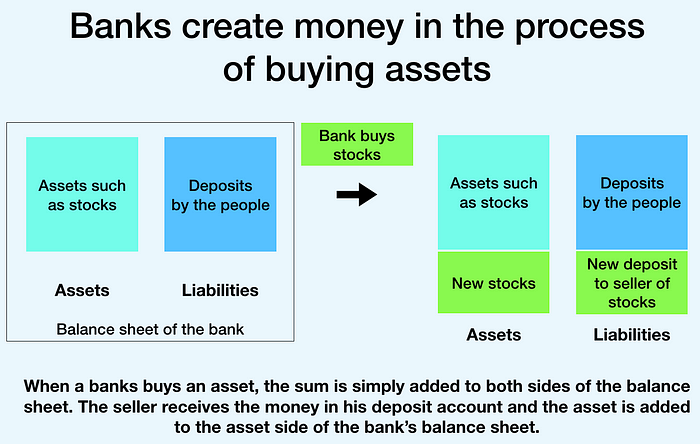

But where did the Federal Reserve receive the funds for buying MBS? The central bank may simply create the money to buy assets as discussed in an article from the Bank of England. The central bank does so by adding the value of the assets on the asset side of the balance sheet and by inserting the funds for the assets to the seller’s bank account. Quantitative Easing works according to the same principle: The central bank buys government bonds from other banks thereby creating the funds out of thin air. The bank accounts can be found in the row “Depository institutions“ which is further explained in the next section.

Bank accounts at the Fed and the reserve requirement

Banks are obliged to hold a certain percentage of their liabilities as reserve at the central bank called “reserve requirement”. The reserve requirement of all banks combined is noted in the row “Depository institutions” on the liability side of the central bank. The central bank primarily holds government bonds and MBS as a reserve for the banks’ deposits. This means that the people’s savings are not more secure with higher reserve requirements since these savings are backed by not necessarily “safer” investments. Essentially, savings can be only considered “safe” when assuming unlimited bank bailouts.

In 2019, the total sum of bank deposits at the Fed accounted for more than USD 1.5 trillion. The percentage of reserves banks need to hold in reserve at central banks is set by central banks. In March 26, 2020 this percentage was set to zero. This means that banks are not required to hold any money in reserves for the debt they give out. However, for being able to serve the claims of customers, they should hold a certain amount of money as reserve. The amount of money which banks hold at central banks that exceed the minimum reserve is called “excess reserve”. The Fed has not charged negative interest rate for excess reserves yet but the ECB has already started to do so. This means that banks holding money at the ECB have to pay for doing so. This puts great strain on banks so they have an incentive to give out more debt to make money from the debt related interest.

Can commercial banks create money individually out of thin air?

There is an ongoing discussion on whether commercial banks may create money individually out of thin air in the process of credit creation. This section first discusses the theoretical background followed by empirical evidence supporting the hypothesis that commercial banks create money out of thin air. It also reflects the view of central banks, which clearly shows that banks can create money from nothing.

Banks as custody providers and investment vehicles

The theoretical part refers to Rothbard’s analysis on money creation in his book „Man, Economy, and State with Power and Market“ first published in 1962, page 801 forth following. Rothbard started his argumentation with banks acting as custody providers during the gold standard which means that gold was used as a currency (in contrast to government-backed fiat money which is essentially backed by future tax payments).

Rothbard explains the concept of money creation with the hypothetical example of the „Star Bank“ offering custody services to the public. For storing 5000 ounces of gold, the bank issued warehouse receipts covering exactly 5000 ounces.

Now the bank decided to perform investments with their clients’ money to increase their revenue. The bank lends out the saver’s money to others, in turn the bank offers an interest rate to their customers. The bank now acts as an investment vehicle. Since the savers want to withdraw their money every now and then, the bank holds some gold in reserve. This gold in reserve is not used for investment purposes. So the bank acts as both: custody provider and investment vehicle.

If more people want to withdraw their money than the bank has reserves, then the bank goes bankrupt. This happened in the past in so-called „bank runs“. This problem could have been mitigated by the bank clearly separating their business as investment vehicle and as custody provider. In such a scenario, the customer can decide which portion of his money he aims to invest and get interest for and which portion of the money he aims to place in custody where he needs to pay custody fees for the service. Also, the bank should be required to be transparent about which investments the people’s money flows to, which is not the case in the current financial system.

The process of money creation through credit creation at commercial banks

In the process of credit creation, an entry on the asset side of the balance sheet is created depicting the claim of the bank on the debtor. Since the system is based upon double entry bookkeeping, a corresponding entry is required. This means that the money that is lent out has to come from somewhere.

The process of credit creation is explained with another example of the Star Bank illustrated in the screenshot below. The asset side shows that 5000 ounces are kept in custody and 1000 ounces of gold were given out to debtors (I.O.U’s from Debtors — I.O.U. refers to “I owe you”). The liability side shows that warehouse receipts worth 6000 ounces of gold were given out. We assume that exactly 1000 ounces more gold were inserted by customers which was then lent out. This means that the debt money originates from the savers depositing their money in the bank. So, the money was merely shifted from saver to debtor where the bank acts as financial intermediary.

This is no problem when the bank first asks their customers whether they agree with this particular investment because in the end, these customers bear the risk of default. The bank becomes the investment vehicle and intermediary for this particular transaction.

But what if the bank creates more warehouse receipts than the total sum of the gold the bank holds in custody and the gold lent out? This is „the creation of new money out of thin air, by issuing receipts for nonexistent gold“ which is called „monetization of debt“ (Rothbard, 1962, p. 809). We use the example above, however, now assuming that the bank created 1000 pseudo warehouse receipts that are not covered by gold. In fact there are only 5000 ounces of gold but the bank acts as if there were 6000 ounces of gold by giving out 6000 pseudo warehouse receipts. In the process of lending out money, 1000 new warehouse receipts were created which are not covered by gold. These are fake money certificates created in the process of debt issuance. So essentially, the bank has issued more money certificates than it can actually redeem. If more customers claim their gold than the bank holds in custody, then the bank goes bankrupt if it is not bailed out.

According to Rothbard „It is, in fact, difficult to see the economic or moral difference between the issuance of pseudo receipts and the appropriation of someone else’s property or outright embezzlement or, more directly, counterfeiting. Most present legal systems do not outlaw this practice; in fact, it is considered basic banking procedure.“ (Rothbard, 1962, p. 809)

When banks engage in fraudulent behavior, they would normally lose customers. Also, other banks would stop lending money to the fraudulent bank. This allows sound checks between banks on their risk and credibility. This was stopped through the nationwide check-clearing system called „Federal Reserve“ which can bail out even the most fraudulent bank. The Federal Reserve published a document explaining its purposes and functions which says the following:

„By creating the Federal Reserve System, Congress intended to eliminate the severe financial crises that had periodically swept the nation, especially the sort of financial panic that occurred in 1907. During that episode, payments were disrupted throughout the country because many banks and clearinghouses refused to clear checks drawn on certain other banks, a practice that contributed to the failure of otherwise solvent banks [Note author: if the banks were solvent they would not need a bailout]. To address these problems, Congress gave the Federal Reserve System the authority to establish a nationwide check-clearing system.“ (Source: Federal Reserve System Publication, Purposes and Functions)

For evidence on whether commercial banks may individually create money out of thin air, we may either look into the source code of the banking system or we look at empirical data. The source code is unfortunately undisclosed. So we may only look at empirical data.

Empirical study on whether commercial banks may create money out of thin air

This section refers to the study “Can banks individually create money out of nothing? — The theories and the empirical evidence“ by Professor Richard Werner. In this study, the cooperating bank granted a loan of 200 000 EUR of maturity under 4 years to Richard Werner. A snapshot of the balance sheet was taken before the transfer and on the next day when the transaction was completed. The study showed the following balance sheet movements of the „Raiffeisenbank”:

We see an increase of around 170 000 EUR on the liability side in the entry „claims by customers“. This entry corresponds to the „pseudo warehouse receipts“ in the analysis of Rothbard. It is quite unlikely that customers inserted so much money as savings on the day regarded. But what else could have moved this entry so much? Let’s remember the mechanism of how central banks created new money — maybe a similar mechanism is applied with commercial banks. Central banks create new money by recording the issued loan as an asset on the asset side and by entering the corresponding money into the banks’ accounts. Commercial banks could make use of the same principle: They can note the loan amount on the asset side and insert this money in the bank account of the debtor. In this process, the credit sum would be added to both sides of the balance sheet: the “claims on customers” on the asset side (the debt) and the “claims by customers” on the liability side of the bank (the loaned money).

A snapshot directly before and after the transaction would have given us more clarity but this is the best to work with for now. The 170 000 EUR of increase in claims by customers is close to the credit sum but does not cover it entirely. So let’s have a look at the other major movements on the balance sheet. Apart from the increase in the claims by customers, we see an increase in cash on the asset side and a decrease in „claims on financial institutions“. This indicates that other banks paid the debt they had with the „Raiffeisenbank“. Since we do not have the balance sheet of all customers and debtors of the Raiffeisenbank, it is not possible to say with absolute clarity which transaction was a pseudo transaction and which was not. But we can have a look at what the central authorities say on Money creation.

Central banks’ view on money creation in the banking system

The German central bank published an article on money creation in 2018. The Bank of England discussed this already in 2014. Both articles describe the same process of money creation at banks and central banks.

Both articles have found that banks and central banks create money by issuing debt. More precisely, the debt is noted on the asset side as a claim on the debtor and the related money is inserted in the deposit account of the debtor. This fits very well to what was explained above.

Both articles have found another mean for money creation namely in the process of buying assets. When a bank or central bank buys an asset, the asset is placed on the asset side of the balance sheet and the related money is placed in the account of the seller of the asset on the liability side.

Concluding, we have great evidence that both banks and central banks create money out of thin air in the process of credit creation and also in the process of asset purchases.

Next, we look at the occurrence of pseudo receipts in history.

Pseudo receipts in the history of money

The most prominent case of pseudo receipts happened during the Bretton Woods System which was in place from 1944 to 1971. In this time period, the US dollar was fixed to gold at USD 35 per ounce of gold. All other currencies were in turn fixed to the US Dollar. The Federal Reserve held the gold in reserve to which the US dollar was pegged to. This means that the Federal Reserve was the only custody provider that held the gold in reserve which is an extreme centralization of trust. Everyone trusted that the Federal Reserve does not create pseudo warehouse receipts, i.e. more US dollars than are covered by the gold reserves. In the 1960s, the first speculators did not trust the Fed anymore and assumed that more US dollars were created than there were gold reserves. This has led to a revaluation of currencies and eventually to the collapse of the Bretton Wood System. Now, the US dollar is pegged to nothing and the Fed may print infinitely.

Note: Here you find one source on Bretton Woods (notice the framing „speculative attacks“ and „confidence problem“ by the public instead of „deception“ and „fraud“ committed by the Fed).

Money alternatives that cannot be created out of thin air

We learned that depositing one’s money in service custody allows the custody provider to easily instigate fraudulent behavior by issuing fake warehouse receipts. We can prevent this by holding our assets in self-custody. But which alternative money is most suitable for self-custody? In the following, Bitcoin and gold are compared as money alternatives.

Bitcoin can be sent over distance almost immediately without a third party. Gold either requires physical shipping which is very slow and comes with a great risk of losing the funds or the gold is held in service custody and merely the ownership is shifted. Storing one’s money in custody requires trust in the custody provider to not issue pseudo receipts. Bitcoin in turn can be held by the individual and can be sent over distance directly to the recipient. Bitcoin does not depend on a trusted centralized authority — Bitcoin is trustless. Moreover, if bitcoin are stored at a custody provider who gives every customer a separate Bitcoin address, then the customer may verify whether the bitcoins are still there 24/7 over the network. This is why Bitcoin is superior over gold even in the situation of custody.

According to Bloomberg, central banks have bought more and more gold just recently. Some people are arguing that the government may introduce a new coin that is backed by gold when the fiat system crashes. But wait! Didn’t the central banks create more US dollars than there was gold in reserve during the Bretton Woods System? Yes. If your government says that a new fiat is issued which is backed by gold where gold is stored in a centralized custody, why should you trust them not to create pseudo receipts if they did so in the past?

Bitcoin is the way out.

I would like to thank Murray Rothbard for his extraordinary logic in laying out the concept of money and its creation. I also thank Professor Richard Werner for conducting the empirical study on money creation at commercial banks. Great thanks to my proofreaders Ben Kaufman, Keyvan Davani and Márton Csernai. I highly appreciate your support in improving this article. Any feedback from subsequent readers is highly welcome!

Note on fractional reserve banking

It is important to differentiate between two different definitions of fractional reserve banking:

- Reserve refers to the percentage of money held in custody which is not lent out. So, a portion of the savers money is held in custody (reserve) and the rest is invested.

- Reserve refers to the percentage of money actually covered by the underlying asset. Gold standard: Only a portion of the money certificates is backed with the underlying asset, the rest are pseudo warehouse receipts. Fiat system: The bank may create money in the process of debt issuance.

Note that with fiat money, it is difficult to differentiate money and money substitutes because both are based on nothing and essentially fake. This is why the definition “money may be created in the debt issuance process” is used.

In a monetary system where money cannot be created through accounting fraud in the process of debt issuance, debt and credit simply show the obligations between people. In such a system, money would be distributed from e.g. the savers account to the debtors account where the bank acts as financial intermediary (see first example by Rothbard in this article). So, fractional reserve banking as per the first definition does not lead to more money created. However, money in custody and money invested should be clearly separated thereby laying on a sound monetary system that is scarce. Bitcoin enables this.

The implications of the second system where money may be created out of thin air by banks and central banks have found deep consideration in the article. We have strong evidence that banks and in particular central banks create new money in the process of debt issuance through accounting fraud. Even the reserves behind the central bank money, which among other things consists of the banks’ minimum reserves, can be used by the central banks for risky investments, which makes the whole concept of minimum reserves ad absurdum. We may conclude that both definitions of Fractional Reserve Banking hold in the current system. The first concept of Fractional Reserve Banking is organic to a sound monetary system. The latter is inorganic and can be only facilitated with fraud or unsound money coming with great distortions to the economy.

Note on whether fiat money is debt or money

Emil Sandstedt brought up the very interesting question on whether fiat money is money or debt during our Podcast with Keyvan Davani. I would consider fiat money as both: debt and money and I lay out why in the following.

Federal Reserve notes are per definition part of the “monetary base” which is the most superior money. Money is in fact differentiated into certain categories (monetary base, M1, M2, M3). So, Federal Reserve notes are money in the narrow sense. In general, the longer the deposit maturity of a savings deposit, the lower its rank in the monetary hierarchy per definition. However, Federal Reserve notes are a claim on future tax payments (see chapter Federal Reserve Notes). Since future tax payments are a form of debt, Federal Reserve Notes can be considered both: money and debt.

Per definition, the other forms of debt generated through credit creation are not considered money in the fiat system but rather as a “counterpart of M3”. On the other side, one can buy things with the money that one received through the credit. So this money can be used as a medium of exchange. This is a reason why this debt can be considered “money”.

This article has not focused on this differentiation for reasons of simplicity. In the end, what one calls calls “money” is based on definitions. Since money created through debt issuance can be used for payments, it is valid to consider it as money as it was done in this article. But also, it is justified to call central bank money as debt since these are a claims on future tax payments — claims on debt. Therefore, I like the term “debt money” implicating that the fiat system is based on debt and that this money is used as a medium of exchange.

Interesting side note: Only central bank money is considered money by government decree.

Illustration of quantitative easing

Quantitative easing involves the purchase of government bonds by the central bank. But the treasuries are first sold to the secondary market. In the process below the treasury is first bought by a pension fund, then by a bank called “Citibank” and then by the Federal Reserve. Alexander Bechtel explains this process very well in this video.